Roth ira contribution calculator 2020

This calculator assumes that you make your contribution at the beginning of each year. Related Retirement Calculator Investment Calculator Annuity Payout Calculator.

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

The Roth IRA has a contribution limit which is 6000 in both 2021 and 2022or 7000 if you are 50 or older.

. Act in March 2020 allowed for the withdrawal of up to 100000 from Roth or traditional IRAs without. For other retirement plans contribution limits see Retirement Topics Contribution Limits. A Roth IRA calculator is an easy online tool to know the maturity amount of your periodical deposit of the the tax-paid amounts.

Not everyone is eligible to contribute this. Discover The Benefits Of A Roth IRA. For 2022 the maximum annual IRA.

The amount you will contribute to your Roth IRA each year. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. Roth Conversion Calculator Methodology General Context.

The Sooner You Invest the More Opportunity Your Money Has To Grow. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. If you have a 401k or other retirement plan at work.

Find a Dedicated Financial Advisor Now. Learn About 2021 Contribution Limits Today. A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA.

Ad Contributing to a Traditional IRA Can Create a Current Tax Deduction. Ad Dont Pay Taxes When You Withdraw Your Money After You Retire. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience.

For tax year 2020 contributions are not allowed in the year in which you turn 70 12 or later. Ad Discover New More Personalized Approach To Helping You Plan Your Retirement With Merrill. Roth Ira Contribution Limit 2021 Calculator.

Get Up To 600 When Funding A New IRA. Roth Ira Calculator Roth Ira Contribution Current age 1 to 120 Age when income should start 1 to 120 Number of years to receive income 1 to 30 Before-tax. Ad Do Your Investments Align with Your Goals.

For comparison purposes Roth IRA and regular taxable. Ad Explore Your Choices For Your IRA. Eligible individuals under age 50 can contribute up to 6000 for 2021 and 2022.

A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free. Wed suggest using that as your primary retirement account. You can contribute up to 20500 in 2022 with an additional.

Amount of your reduced Roth IRA contribution. Open a Roth IRA Account. 2020 Roth IRA Income Limits.

Get Up To 600 When Funding A New IRA. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Eligible individuals age 50 or older within a particular tax year can make an.

Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more. The Roth IRA has contribution limits which are 6000 for 2022.

Start with your modified. Get Up To 600 When. If the amount you can contribute must be reduced figure your reduced contribution limit as follows.

Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. For 2022 2021 2020 and 2019 the total contributions you make each. And Roth contribution calculator.

Explore Choices For Your IRA Now. You cannot deduct contributions to a Roth IRA. Find out using our IRA Contribution Limits Calculator.

Ad Use Our Calculator To Help Determine How Much You Are Eligible To Contribute To An IRA. Annual IRA Contribution Limit. An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

Use AARPs Free Online Calculator to Calculate Your Tax Deferred Growth. Discover Fidelitys Range of IRA Investment Options Exceptional Service. Skip to account login Skip to Main.

Ad Discover New More Personalized Approach To Helping You Plan Your Retirement With Merrill.

Historical Roth Ira Contribution Limits Since The Beginning

Backdoor Roth Ira 2021 A Step By Step Guide With Vanguard Physician On Fire Roth Ira Vanguard Roth

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

What Are Roth Ira Accounts Nerdwallet Roth Ira Individual Retirement Account Ira Investment

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

Traditional Vs Roth Ira Calculator

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Roth Ira Calculator How Much Could My Roth Ira Be Worth

Pin On Usa Tax Code Blog

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Roth Ira Contribution

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

What Is The Best Roth Ira Calculator District Capital Management

What Is The Best Roth Ira Calculator District Capital Management

Compound Interest Calculator Roth Ira Sale 57 Off Www Ingeniovirtual Com

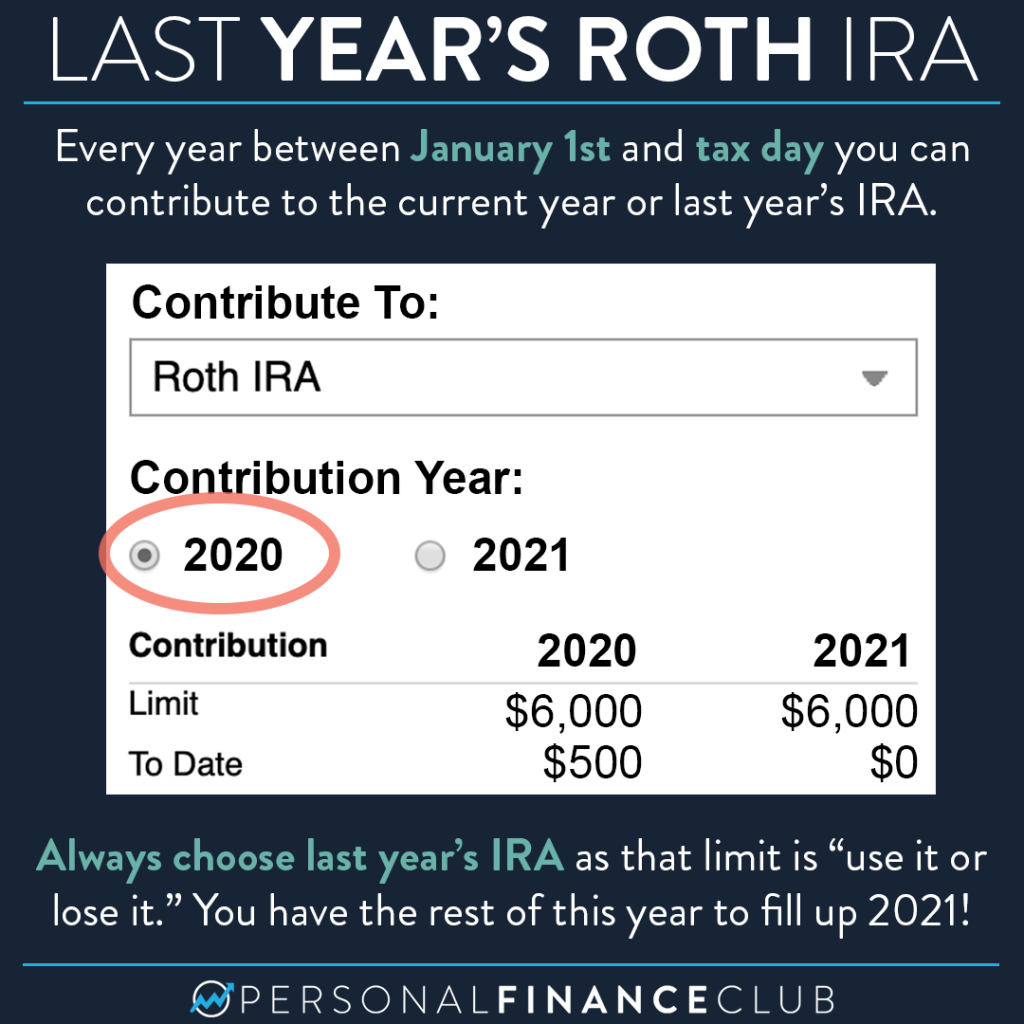

Can I Still Contribute To My 2020 Roth Ira Personal Finance Club