49+ what percent of net income should go to mortgage

Some applicants get approved with DTIs or 45. The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income.

What Percent Of Income Should Go To My Mortgage

Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income.

. With a Low Down Payment Option You Could Buy Your Own Home. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Ad Tired of Renting.

Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Why Rent When You Could Own. The 28 rule The 28 mortgage rule states that you should spend 28 or less.

Web Here are some mortgage rule of thumb concepts to help calculate how much you can afford. Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment. If you have a lot of debt or other financial obligations this percentage may.

Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. Web Not everyone can afford to pay a mortgage that takes up to 28 percent of their income. Web The most common rule of thumb to determine how much you can afford to spend on housing is that it should be no more than 30 of your gross monthly income.

Web It recommends you spend up to 50 of your monthly after-tax income aka net income toward essential expenses needs like your mortgage payment utility. John in the above example makes. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership.

Web Front-end DTI measures how much of your monthly gross pre-tax income goes toward your mortgage payment both principal and interest property taxes and mortgage. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. Compare More Than Just Rates.

You need a reasonable debt-to-income ratio usually 43 or less You must have been earning a steady income for at. Web The 3545 model. A lender suggests to not.

Web Once the average income is determined a mortgage lender will confirm the DTI and recommend an eligible monthly mortgage payment. Get A Custom Rate And Payment Quote On A New Mortgage. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

The most common way to pay for PMI is a monthly premium added to your. Web Income requirements for a mortgage. But thats a very general guideline.

Web Most lenders look for a maximum DTI of 40 on applications for most sorts of mortgages. Web Typically conventional loans require PMI when you put down less than 20 percent. This rule says that you should not spend more than 28 of.

Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage. Web 25 Post-Tax Model. And you should make.

With a Low Down Payment Option You Could Buy Your Own Home. Ad Top Home Loans. A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your.

Find A Lender That Offers Great Service. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

17hylxe

Debt How Do I Account For Monthly Expenses When Calculating How Much House I Can Afford Personal Finance Money Stack Exchange

49 Best Wordpress Plugins In 2023 Most Are Free

What Percentage Of Your Income Should Go To Your Mortgage Hometap

Ekaterinburg And Sverdlovsk Region Marchmont Capital Partners

Pdf Families Incomes And Jobs

The Percentage Of Income Rule For Mortgages Rocket Money

Explaining The Bundesliga S 50 1 Rule World Football Faq Bundesliga

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much Of My Income Should Go Towards A Mortgage Payment

What Percent Of Income Should Go To My Mortgage

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Nord Lb Group Annual Report 2007 Pdf 1 8

Arithmetic Material Pdf Fraction Mathematics Division Mathematics

How Much Of My Income Should Go Towards A Mortgage Payment

What Is My Hand Salary If My Ctc Is 46 Lpa Quora

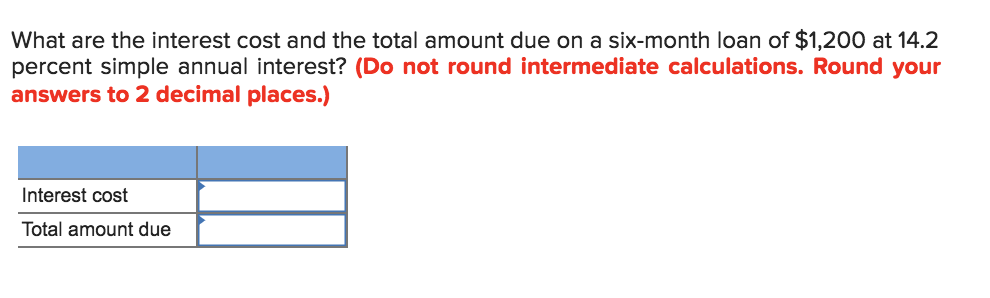

Solved What Is Your Debt Payments To Income Ratio If Your Chegg Com